THE GREEK ECONOMY UP TO 2021: FEBRUARY 2017

In the present post, estimates are put forward over the Greek economy as part of the Eurozone and the global economy, using the Global Economic Model of the Oxford Economics. In the Greek model all individual developments to date have been incorporated, including the policies agreed until the first review of the 3rd program. The estimates are for the period from 2017 to 2021.

The current economic policy consists of: a) achieving the targets of the Economic Adjustment Programme for the period 2017-2018 and b) extending the current policy into the period 2018-2021. We name this model the Basic Model (BM).

In the BM we examine whether there is a divergence in the primary surplus from the targets set in the "Supplemental Memorandum of Understanding" for the Greek economy (16//06/2015) (0.5% in 2016, 1.75% in 2017 and 3.5% from 2018 onwards). In all the years for which the analysis is performed (2016-2021), the primary balance is expected to be greater -or within the limits- than the targets that have been set, except from the year 2018 (Table 1). In that year the difference between the primary surplus and the target is going to be 0.48% which means that the fiscal cutter has to be implemented by incorporating measures of 0.97 bn euros from 2019 and onwards.

Table 1. The primary fiscal surpluses

After taking into account that those measures are going to reduce the general government expenditures by 0.97 bn euros each year from 2019 and onwards, in Table 2 we present the results of the BM for the Greek economy.

Table 2. The BM for the Greek economy

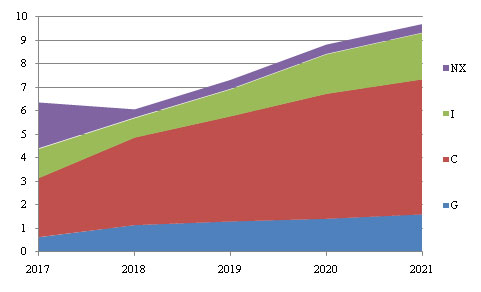

The estimations of the BM, regarding the factors that contribute to GDP (Figure 1), show that private consumption has the largest contribution to the annual changes in GDP, since it contributes from 39.9% in 2017 is expected to contribute by 59% to 62% of GDP growth from 2018 and onwards. Government consumption contributes by 9.9% on 2017 and about 16% to 19% for the years 2018-2021. Investments contribute to about 19.6% in 2017, 13.7% in 2018, 15.7% in 2019 and to 19% to 20% in 2019 and 2020. Lastly, net exports contribute by 30.7% to GDP growth in 2017, but for the period 2018-2021 do not contribute significantly (about 5% each year).

Figure 1. Contribution to GDP change (bn euros)

Notes: NX: Net Exports, I: Investments, C: Private Consumption, G: Government Consumption.

The GDP of the Greek economy, after 9 consecutive years of recession (except in 2014, when a slight increase in GDP was recorded), is expected to follow a positive trend from 2016 onwards. The main reasons responsible for the direct recovery of GDP, at least for 2017 and 2018, are primarily the publicly financed investments and the controlled (because of capital controls) external balance of payments. Then, the recovery takes more universal characteristics1.

From 123.3 billion euros in 2016, private consumption is expected to reach 145.2 billion euros in 2021. The personal disposable income was on a downward trend after 2009 and reached its lowest levels in 2015 and 2016. It will start to rise slowly and in 2021 it will cover half of the difference from 2009. In other words, the improvement of the macroeconomic fundamentals will have a very slow positive effect on the citizens’ perception of the improvement of the economic situation. This is extremely worrying for economic and social cohesion and should be reversed by accelerating the positive economic developments.

Investments decreased significantly due to the economic crisis in the Greek economy. However, from 2017 onwards, a fairly significant increase in investments is expected. Indeed, from 20.18 billion euros in 2016, investments are expected to reach 27.06 billion euros in 2021.

Support for investment through private capital requires the disposal of stored funds from individuals. However, it is observed that private savings are expected to remain in the negative, which means that they will be reduced each year - a fact that hampers investment activity.

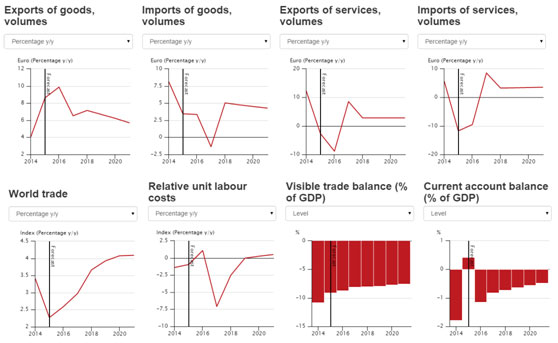

The competitiveness of the Greek economy is expected to be decreasing until 2018, and then it is expected to move upwards.

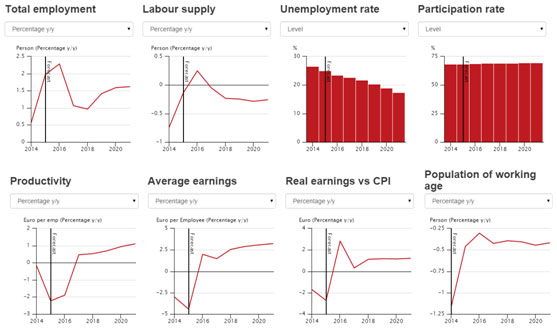

With regard to employment, the trend is quite positive for the Greek economy from 2014 onwards. Thus, by 2021 the number of employed is expected to reach 4,392 thousand people. Similarly, the unemployment rate is expected to reach 17.36% in 2021.

Regarding the external balance of the economy, and more specifically the current account balance, it is expected to remain relatively stable at a deficit of around 1 to 1.5 billion euros, i.e. at about 0.5% of GDP.

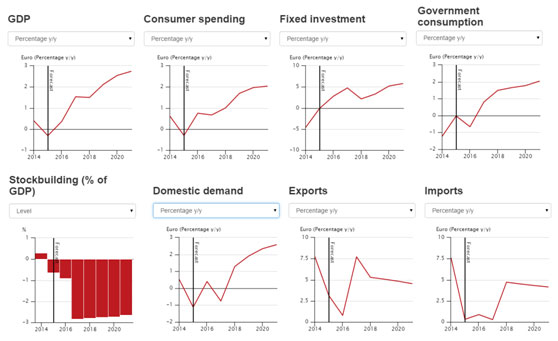

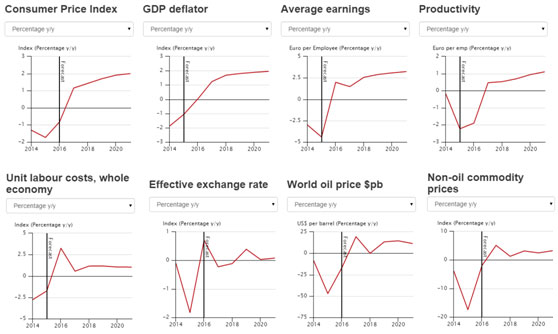

The figures below present an overall picture of the developments in the Greek economy up to 2021.

GDP and its Components

Inflation and its Determinants

Trade and Balance of Payments

Labour Market

1. If any economy has stagnant growth rates in the areas affecting growth (e.g. external balance, private investment, consumption) and at least one sector (public investment) registers a positive growth rate positively, then the growth rate of the entire economy is positively affected.

* Κάθε κείμενο που δημοσιεύεται στο InDeep Analysis εκφράζει και βαραίνει αποκλειστικά τον συντάκτη του. Οι αναλύσεις που δημοσιεύονται δεν συνιστούν συμβουλές για οποιουδήποτε είδους δραστηριότητα. Το InDeep Analysis δεν δεσμεύεται από τις πληροφορίες, τις απόψεις και τις αναλύσεις που δημοσιεύονται στην ψηφιακή πλατφόρμα του, και δεν φέρει απολύτως καμία ευθύνη για αυτές.

Online διαδραστική πλατφόρμα προβολής του πολιτισμού των Ελλήνων σε ολόκληρο τον κόσμο.

Μπες στο www.act4Greece.gr Επίλεξε τη ∆ράση YOU GO CULTURE

Κάνε τη δωρεά σου με ένα κλικ στο

ΘΕΛΩ ΝΑ ΠΡΟΣΦΕΡΩή με απ’ ευθείας κατάθεση ή μέσω internet, phone και mobile banking.

Πρόγραμμα Crowdfunding